Balancer DAO: Assessment & Proposal

Introduction

Karpatkey has been tasked by the Balancer DAO, as per BIP-103, with deploying yield-generating strategies using the existing funds in the treasury in a risk-adjusted, trust-minimized, and non-custodial manner. The following paragraphs outline the general approach that will be followed and provide insight on the following topics:

- Assumptions used to determine the funds within the scope of Karpatkey

- Initial asset composition

- Allocation proposals for the Balancer DAO to vote on

- Projected results

Links to Balancer DAO wallets

- Mainnet: 0x10a19e7ee7d7f8a52822f6817de8ea18204f2e4f

- Polygon: 0xee071f4b516f69a1603da393cde8e76c40e5be85

- Arbitrum: 0xaf23dc5983230e9eeaf93280e312e57539d098d0

Assessment of current portfolio allocation

The current portfolio allocation includes 86% idle assets and 14% invested in strategies generating approximately $86,000 per year. Most of these strategies do not seem to be focused on generating returns and some may even be in negative territory if Impermanent Loss is considered.

| # | Protocol | Position | Chain | Balance $ | Share | APR | Rev. $ |

| 1 | Wallet | BAL | Mainnet | $25,692,025 | 77.05% | 0.00% | $0 |

| 2 | Wallet | USDC | Mainnet | $2,017,695 | 6.05% | 0.00% | $0 |

| 3 | Wallet | AAVE | Mainnet | $908,259 | 2.72% | 0.00% | $0 |

| 4 | Wallet | WETH | Mainnet | $20,333 | 0.06% | 0.00% | $0 |

| 5 | Ribbon | BAL | Mainnet | $1,037,083 | 3.11% | 0.00% | $0 |

| 6 | Balancer V2 | Balancer Boosted Aave USD | Mainnet | $693,876 | 2.08% | 0.00% | $0 |

| 7 | Balancer V2 | WBTC + ETH | Mainnet | $269,750 | 0.81% | 0.35% | $944 |

| 8 | Balancer V2 | D2D + BAL | Mainnet | $58,432 | 0.18% | 0.14% | $82 |

| 9 | Balancer V2 | ETH + GTC | Mainnet | $34,356 | 0.10% | 0.00% | $0 |

| 10 | Gnosis | GNO | Mainnet | $758,926 | 2.28% | 0.00% | $0 |

| 11 | Lido | ETH (stETH) | Mainnet | $375,714 | 1.13% | 4.40% | $16,531 |

| 12 | Lido | ETH (wstETH) | Mainnet | $205,369 | 0.62% | 4.40% | $9,036 |

| 13 | Aave | BAL | Mainnet | $537,388 | 1.61% | 3.40% | $18,271 |

| 14 | Across V2 | BAL | Mainnet | $212,413 | 0.64% | 0.49% | $1,037 |

| 15 | Silo | BAL | Mainnet | $88,030 | 0.26% | 19.38% | $17,060 |

| 16 | mStable | MTA | Mainnet | $14,135 | 0.04% | 3.17% | $448 |

| 17 | Balancer V2 | MATIC + USDC + WETH + BAL | Polygon | $263,512 | 0.79% | 4.45% | $11,726 |

| 18 | Balancer V2 | WBTC + WETH + USDC | Arbitrum | $157,217 | 0.47% | 6.94% | $10,911 |

| Total | $33,344,512 | 100.00% | $86,047 |

Assumptions

Karpatkey has made certain assumptions regarding the current allocation of funds in the Balancer DAO’s portfolio in order to determine which assets and strategies are in scope for generating returns. These assumptions include:

- Approximately 77% of the total funds, or around 5 million BAL, are idle on the wallet and will not be deployed in any strategies in order to preserve the voting power of the main stakeholders.

- Following the stated criteria, four positions involving BAL that are the result of strategic partnerships with other parties, as well as the BAL position on Ribbon Finance and the MTA position on mStable, will not be included in any strategies;

- The ETH portion of the ETH-GTC position on Balancer will be included, while the GTC portion will not;

- The 16,907 AAVE on the wallet, which are part of an ongoing agreement with AAVE, will be included and potentially deployed through staking or lending strategies;

- The USDT + DAI + USDC and WBTC + ETH positions on Balancer, and the stETH and wstETH positions on Lido, can be dismantled and redeployed;

- The MATIC + USDC + WETH + BAL and WBTC + WETH + USDC positions on Balancer v2 on Polygon and Arbitrum, respectively, can be dismantled, bridged back to the mainnet, and redeployed, with the exception of the BAL and MATIC assets which will not be included;

- Any risk-adjusted protocol or strategy can be proposed for approval and whitelisting, except for those that use Balancer products or yield BAL as part of their rewards structure;

- The portfolio’s asset composition will not be changed, and assets will only be used for yield-generating strategies.

New allocation proposal

Now that the assumptions have been made, Karpatkey identifies the initial scenario in terms of assets that are in scope and introduces two proposals for the Balancer DAO to consider and vote on. The first proposal, known as the “base allocation”, suggests using well-known staking, lending, and AMM protocols in order to keep the complexity of the strategies low and facilitate risk management. The second proposal, known as the “expanded allocation”, suggests expanding the list of protocols to include fixed-rate lending and other structured product categories in order to broaden the range of possibilities and allow for more complex strategies that are expected to yield better returns. The two allocation proposals provide specific recommendations for how these assets should be deployed in order to generate returns.

Initial Scenario

The following table shows the assets that are considered in-scope by Karpatkey:

| Token | Category | Protocol | Position | Chain | Balance | Price | Total Value $ | Share |

| USDC | Stablecoins | Wallet | - | Mainnet | 2,017,695 | $1.00 | $2,017,695 | 42.16% |

| AAVE | AAVE | Wallet | - | Mainnet | 16,907 | $53.72 | $908,259 | 18.98% |

| WETH | ETH | Wallet | - | Mainnet | 17 | $1,218.18 | $20,333 | 0.42% |

| USDT | Stablecoins | Balancer v2 | Balancer Boosted Aave USD | Mainnet | 328,055 | $1.00 | $328,055 | 6.85% |

| DAI | Stablecoins | Balancer v2 | Balancer Boosted Aave USD | Mainnet | 180,329 | $1.00 | $180,329 | 3.77% |

| USDC | Stablecoins | Balancer v2 | Balancer Boosted Aave USD | Mainnet | 185,492 | $1.00 | $185,492 | 3.88% |

| WBTC | WBTC | Balancer v2 | WBTC + ETH | Mainnet | 8 | $16,688.22 | $134,841 | 2.82% |

| ETH | ETH | Balancer v2 | WBTC + ETH | Mainnet | 111 | $1,218.25 | $134,909 | 2.82% |

| ETH | ETH | Balancer v2 | ETH + GTC | Mainnet | 6 | $1,218.25 | $6,761 | 0.14% |

| stETH | ETH | Lido | Staking | Mainnet | 312 | $1,203.21 | $375,714 | 7.85% |

| wstETH | ETH | Lido | Staking | Mainnet | 155 | $1,327.36 | $205,369 | 4.29% |

| USDC | Stablecoins | Balancer v2 | MATIC + USDC + WETH + BAL | Polygon | 65,599 | $1.00 | $65,599 | 1.37% |

| WETH | ETH | Balancer v2 | MATIC + USDC + WETH + BAL | Polygon | 54 | $1,218.18 | $65,721 | 1.37% |

| WBTC | WBTC | Balancer v2 | WBTC + WETH + USDC | Arbitrum | 3 | $16,688.22 | $52,401 | 1.09% |

| WETH | ETH | Balancer v2 | WBTC + WETH + USDC | Arbitrum | 43 | $1,218.18 | $52,382 | 1.09% |

| USDC | Stablecoins | Balancer v2 | WBTC + WETH + USDC | Arbitrum | 52,434 | $1.00 | $52,434 | 1.10% |

| Total | $4,786,294 | 100.00% |

Base allocation

If this proposal was selected, specific functions within the protocols below would be whitelisted. More technical details regarding the whitelisting process will be provided shortly.

- Staking:

- Lido

- Stakewise

- Lending:

- Compound v2

- Aave v2

- AMM:

- Uniswap v3

It is worth noting that the above protocols and categories are considered to be the most battle-tested and proven yield generation alternatives in the industry. Therefore, we consider them to be aligned with the objectives, scope and time orientation of the Balancer DAO.

Should existing funds be deployed within the base alternative, the allocation would be as follows:

| # | Protocol | Position | Balance $ | Share of Portfolio | APR % | Proj. Rev $ | Share of Rev. |

| 1 | Lido | Stake ETH | $404,894 | 8.46% | 4.40% | $17,815 | 10.78% |

| 2 | Uniswap v3/Stakewise | SETH2/ETH | $262,243 | 5.48% | 14.35% | $37,632 | 22.77% |

| 3 | Aave v2 | AAVE on Safety Module | $454,130 | 9.49% | 8.41% | $38,192 | 23.10% |

| 4 | Compound v2 | Deposit AAVE | $454,130 | 9.49% | 3.19% | $14,487 | 8.76% |

| 5 | Uniswap v3 | WBTC + ETH, Range: 11.786 - 15.082. Fee: 0.3%. | $381,294 | 7.97% | 2.49% | $9,494 | 5.74% |

| 6 | Compound v2 | USDC | $1,414,802 | 29.56% | 1.61% | $22,778 | 13.78% |

| 7 | Compound v2 | DAI | $1,414,802 | 29.56% | 1.76% | $24,901 | 15.06% |

| Total | $4,786,294 | 100.00% | 3.45% | $165,299 | 100.00% |

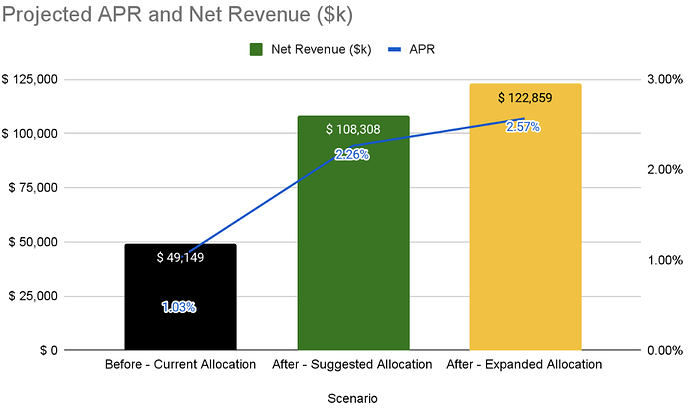

The expected revenues for the current deployment of approximately $4,800,000 are approximately $165,000. The total current revenues of the Balancer DAO are $86,047, but this includes assets outside the scope of this proposal. For a fair comparison, the proposed expected revenues should be put up against the current revenues generated by the in-scope assets of the Balancer DAO, which are $49,149. When only considering the in-scope assets, the expected revenues from the base allocation proposal represent more than three times the current portfolio performance.

Expanded allocation

In pursuit of tapping into other attractive opportunities that DeFi has to offer, here is the expanded alternative with new protocols and categories.

- Staking:

- Rocket Pool1

- Lending:

- Euler Finance1

- Fixed-rate lending:

- Element Finance

- Notional Finance

- Idle Finance1

- Other structured products:

- Ribbon Finance1

Should existing funds be deployed within the expanded alternative, the allocation would be as follows:

| # | Protocol | Position | Balance $ | Share of Portfolio | APR % | Proj. Rev $ | Share of Rev. |

| 1 | Lido | Stake ETH | $202,447 | 4.23% | 4.40% | $8,908 | 4.85% |

| 2 | Uniswap v3/Stakewise | SETH2/ETH | $262,243 | 5.48% | 14.35% | $37,632 | 20.51% |

| 3 | Element Finance | ePyvcrvSTETH/steCRV LP | $202,447 | 4.23% | 7.00% | $14,171 | 7.72% |

| 3 | Aave v2 | AAVE on Safety Module | $454,130 | 9.49% | 8.41% | $38,192 | 20.81% |

| 4 | Compound v2 | Deposit AAVE | $454,130 | 9.49% | 3.19% | $14,487 | 7.90% |

| 5 | Uniswap v3 | WBTC + ETH, Range: 11.786 - 15.082. Fee: 0.3%. | $381,294 | 7.97% | 2.49% | $9,494 | 5.17% |

| 6 | Compound v2 | USDC | $914,802 | 19.11% | 1.61% | $14,728 | 8.03% |

| 7 | Compound v2 | DAI | $1,414,802 | 29.56% | 1.76% | $24,901 | 13.57% |

| 8 | Notional Finance | USDC - Maturity: Dec 18, 2023. | $500,000 | 10.45% | 4.20% | $20,975 | 11.43% |

| Total | $4,786,294 | 100.00% | 3.83% | $183,488 | 100.00% |

In this case, the expected revenues are more than $183,000, which is almost four times the current portfolio performance.

There’s also potential to continue expanding the portfolio by tapping into strategies that involve leverage. Protocols like MakerDAO, Reflexer, Liquity and QiDAO offer the possibility to provide assets as collateral and borrow stablecoins to be used for carry-trade strategies that yield a net positive result. However, we leave the analysis of these possibilities for a later stage.

1 not directly proposed in the expanded allocation strategy but could be added eventually for diversification purposes.

Summary

Overall, implementing risk-adjusted yield-generating strategies can significantly improve the performance of the Balancer DAO’s portfolio. An analysis of the before and after scenarios is provided below.

| Before - Current Allocation | |

| Total Funds | $ 4,786,294 |

| Utilized Funds | $ 1,840,007 |

| Capital Utilization | 38.44% |

| Revenues2 | $ 49,149 |

| Avg. APR | 1.03% |

2 For comparison purposes, only revenues generated from assets within scope are considered.

| After - Base Allocation | |

| Total Funds | $ 4,786,294 |

| Utilized Funds ($k) | $ 4,786,294 |

| Capital Utilization | 100.00% |

| Revenues ($k) | $ 165,299 |

| Gross APR | 3.45% |

| Management Fee (calculated over AUM) | 0.50% |

| Performance Fee (calculated over revenue) | 20.00% |

| Net Revenues | $ 108,308 |

| Net APR | 2.26% |

| After - Expanded Allocation | |

| Total Funds | $ 4,786,294 |

| Utilized Funds ($k) | $ 4,786,294 |

| Capital Utilization | 100.00% |

| Revenues ($k) | $ 183,488 |

| Gross APR | 3.83% |

| Management Fee (calculated over AUM) | 0.50% |

| Performance Fee (calculated over revenues) | 20.00% |

| Net Revenues | $ 122,859 |

| Net APR | 2.57% |

Overall, the proposed strategies are expected to generate an annual net result for the Balancer DAO, ranging from $108,000 to $122,000.

Additional considerations

- Rewards management: all generated rewards will be either swapped to ETH or stablecoins (at Karpatkey’s discretion) and redeployed into existing strategies to compound the results.

- New SAFE multisig: to better organize the assets within the scope of Karpatkey, we suggest creating a new SAFE wallet (with the same signers as the current one) and transferring the in-scope assets to it. The Balancer DAO will not give up custody of the funds and the Manager Roles will be applied to the new SAFE, keeping out-of-scope funds separate.