Dear Balancer community,

As part of our commitment to accountability, transparency, and open communication, we’re pleased to share another update with the Balancer community. This report details our progress since Q1 and outlines our ongoing efforts to support the protocol.

- Liaising with the board on budgets, project proposals, and matters particularly as it relates to service providers including the BVI subsidiary

As part of this role, reporting to the Foundation Board and the Ecosystem Council is being done in a timely manner on all matters of importance, including financial status, funding projections, program operations, and employee matters.

- Manage Finances and Service Providers

Alongside @Lemma, we have concluded Q4 financial reports, and Lemma published the Balancer FY25 Q1 Transparency Report in May, with a granular view of the expenses (forecast/actual) for the period for both the Foundation and its subsidiary Balancer Opco.

Every on-chain transaction is pre-approved by the Balancer Foundation board (¾ multisig). All the off-chain payments are overseen by the board, @Lemma and @kpk for cross-referencing (see the latest State of the DAO reports here).

Foundation/OpCo has also led the initiative to run exit surveys with former contributors and satisfaction surveys with active contributors. This is an ongoing process for developing a strategy for retention and learning how to best approach the pain points causing churn and disruptive turnover.

Other developments:

-

Managed expenses for Ecosystem ONsite;

-

Managed expenses for Dappcon and EthCC (BD/MKT) participation;

-

Managed sponsorship for Ipê City (Brazil) and Dappcon (Germany)

-

Onboarding 1inch developer tools

-

Onboarding Optimism and Avalanche (KYC/KYB) for incentives/grants

-

Other BD event participation budgeting and planning (travels, merch, etc)

-

Draft and proposal for OpCo infra, product and marketing budgets

-

Onboarding service providers (FTE)

-

Onboarding MOIC (marketing service provider)

-

Resignation of Alberto (lead - frontend team)

3. Compliance and Risk Management

During Q2, we initiated the discussions that led to the RFC for the incorporation of a new BVI company to house Balancer protocol business and onchain operations, in several meetings with our in-house counselor, @kpk, Balanacer Maxis and BLabs.

Other developments and activities include:

-

Copywriting for BTF(QuantAMM) risk section

-

Copywriting for ReCLAMM risk section

-

Liaison with @kpk regarding financial reports, IPS, and Treasury migration

-

Balancer Policy updates

-

Security guidelines updates

4. Community Engagement

The high point for the community, was undoubtedly another edition of the Ecosystem ONsite, this time held in Brazil. These events require much work and planning, and this time it was all done in-house, without any help from external agencies. It was considered a great success, both from the perspective of the attendees and leaders, who had the opportunity to coordinate and share a common vision for Balancer and the road ahead.

In other news, through active participation in Polygon Governance, Balancer Foundation has received an impressive amount of POL tokens delegated, now being one of highest-ranked delegates by voting power. Through the delegate incentive program quarterly rewards, combined with [BIP-851], we intend to grow this stack even more.

Other developments under “Community Engagement”:

-

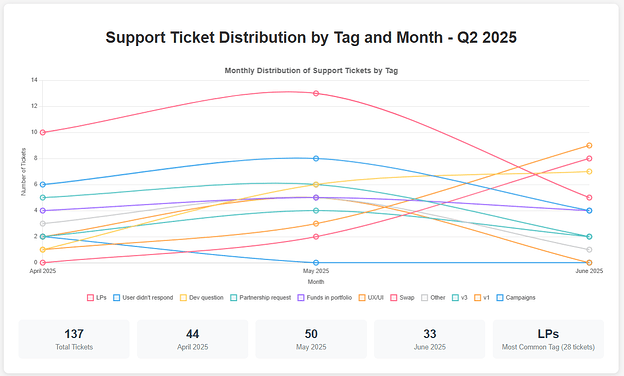

User support tickets (see below)

-

The Balancer Report (newsletter) was halted, and is currently being revamped under the new marketing team.

-

Discord safety monitoring (bots, automod commands, etc)

5. What’s next?

Please expect the financial analysis for Q2 dropping in due time, as well as the full year report. Check out data metrics below regarding our ticket system and user support (Discord).