TL;DR

- Residual Token, Inc. proposes to build, launch and maintain BalancerP2PTM, a savings, lending and borrowing tool that will integrate into the existing BalancerTM ecosystem.

- Residual Token, Inc. will not charge Balancer development or maintenance fees, and Balancer will not incur any out-of-pocket licensing or whitelisting fees.

- Residual Token, Inc. requests that Balancer - at its own expense - adds hyperlinks to its website that point to BalancerP2P, and advertises BalancerP2P to its users.

- Liquidations, a common function required to keep a P2P platform healthy, are managed by outside bots with no economic benefit to Residual Token nor Balancer.

Summary

Residual Token, Inc. (dba unFederalReserve) proposes to offer Balancer a license to BalancerP2P, a front-end interface to the ReserveLending Core.

The ReserveLending Core (hereafter, the ‘Core’) is an overcollateralized Pool-to-Peer1 lending protocol that brings together savers, lenders and borrowers from a variety of cryptocurrency ecosystems, platforms and brands. This global connectivity is facilitated by the use of multiple front-ends that each provide access to the Core’s single set of liquidity pools.

The Licensor, Residual Token, Inc. (hereafter, ‘Residual’), will build and maintain the BalancerP2P front-end, and will not charge the Licensee, Balancer, development or maintenance fees (development is estimated to cost around $50,000 of Residual’s own capital, and maintenance is approximately $3,000/mos). Balancer will not incur any out-of-pocket licensing or whitelisting fees for hosting BalancerP2P.

Balancer’s treasury will earn 10% of the reserves generated from borrowers connecting through BalancerP2P. In other words, it will earn a portion of the APY that BalancerP2P borrowers pay on loans, and in the case of loan defaults, it will earn a portion of the recovered collateral.

Additionally, revenues from existing Balancer trading tools are projected to increase due to higher trading volume. Residual projects a 30-40% increase in Balancer’s trading volume as users take advantage of interest paying deposit accounts and affordable loans available through BalancerP2P. Detailed projections are available in the Forecast section below.

Note, the extent of work requested to be undertaken by Balancer - at its own expense - will be:

- Adding hyperlinks to the Balancer website that point to BalancerP2P.

- Advertising BalancerP2P to both existing and future Balancer users.

At the user level, BalancerP2P will:

- Empower Metamask, Wallet Connect and Coinbase Wallet users to earn APY - without relinquishing custody of their cryptocurrency to a third-party - via BalancerP2P‘s Supply or Deposit function;

- Allow users to borrow a select set of cryptocurrency types on an overcollateralized basis at reasonable APYs; and

- Provide users the ability to leverage up, short sell certain assets, or increase purchasing power using safe, reliable and easy-to-use features.

Balancer’s users will also have the added bonus of combining the above benefits with the robust trading tools already offered by Balancer, thus spending more time in the Balancer ecosystem, and increasing overall engagement with the Balancer product suite.

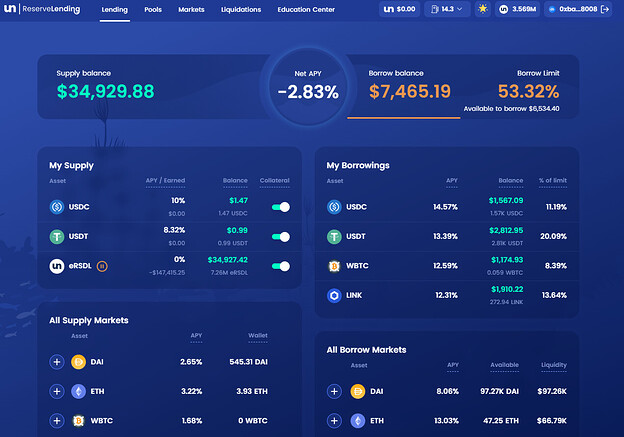

The BalancerP2P user interface will be custom designed to fit Balancer’s existing brand style. Below are sample images of Residual’s own front-end, ReserveLendingTM. The BalancerP2P front-end will share a similar overall layout, along with custom Balancer theming across multiple webpages. (See also: https://app.unfederalreserve.com/markets)

Example I: User View of Current Deposits and Loans Outstanding

Example II: Market Overview

Example III: Liquidations

Example IV: Education Center

Also included with BalancerP2P will be a range of “how-to” videos, along with user access to experts in the DeFi community. These experts will provide knowledge to the Balancer community on strategies to employ depending on Balancer’s users’ wishes and market conditions.

For

Onboard Balancer as a Licensee to BalancerP2P, a front-end of the ReserveLending Core. Residual will build the customized front-end for Balancer at no cost to Balancer. BalancerP2P will provide Balancer users access to the ReserveLending Core in an experience simpatico with the Balancer platform today, and will earn Balancer 10% of reserves generated through BalancerP2P. Balancer - at its own expense - will add hyperlinks to its website that point to BalancerP2P, and will advertise BalancerP2P to its users.

Against

Do not onboard Balancer as a Licensee to BalancerP2P.

Context

In business since 2017, Residual Token, Inc. is a Fintech SaaS company specializing in banking, Web3 and DeFi software development. Licensing software is Residual’s primary source of revenue, and a live utility token, eRSDL, is used as part of its Licensing-as-a-Service (LaaS) model, which is explained in detail here: Licensing as a Service (LaaS) for blockchain enterprise solutions | by unFederalReserve | Medium

The ReserveLending Core is a retail DeFi protocol for overcollateralized Pool-to-Peer1 lending and borrowing that is owned by Residual. The Core is based on the Compound® Protocol, which is non-custodial, meaning that Residual does not have control over supplied assets, and users are not exposed to the typical risks inherent in centralized custodial lending. The Core is also permissionless, meaning that any address is free to access the Core’s liquidity pools. A review of the Core’s activity can be found here: unFederalReserve - Key Metrics

Front-ends (interfaces) to the Core allow users to supply assets to earn APY, and optionally use their supplied assets as collateral to borrow on margin. Users across all Core front-ends share access to the same Core liquidity pools. This means that a user accessing the Core from one front-end can supply assets to a liquidity pool; while a user accessing the Core from another front-end can borrow those assets from the same liquidity pool (assuming the borrower has supplied enough collateral to satisfy this key condition to the loan).

Residual hosts a front-end to the Core, branded ReserveLending™. Residual also offers front-end licenses to third parties (Licensees). Front-ends are custom-themed for Licensees, allowing for seamless integration with existing branded ecosystems.

Residual will build and maintain a customized front-end for Licensees, and will not charge Licensees development or maintenance fees. Furthermore, Licensees will not incur any out-of-pocket licensing or whitelisting fees for hosting a front-end.

The extent of work required to be undertaken by a Licensee - at its own expense - will be:

- Adding hyperlinks to its website that point to the front-end.

- Advertising the front-end to both existing and future users.

Allocation of Reserves

The reserves accumulated by the Core are allocated to:

- Rewards paid to Licensees

- License fees collected by Residual Token, Inc. (aka unFederalReserve)

Rewards paid to Licensees

The total allocation of Licensee rewards is divided amongst Licensees in amounts reflecting the percentage of the total TVL that is borrowed from the Core through each Licensee’s front-end. Residual tracks and reports on these amounts using URL-related analytics and activity mapping. In this case, Residual will track Core activity tied to the BalancerP2P front-end - using its URL - when estimating the licensing fee. Please refer to the Forecast section for detailed reward projections.

License fees collected by Residual Token, Inc. (aka unFederalReserve)

Given that Licensees do not pay any out-of-pocket licensing fees, Residual collects licensing fees from the Core reserves. In line with the Licensing-as-a-Service (LaaS) model, part of the licensing fees will be directed to reimburse Residual for its costs and profit expectations, and part will be used to conduct open market purchases of eRSDL tokens (eRSDL tokens are digital markers representing license state, and are burned as licenses are consumed).

Licensee benefits of hosting a Core front-end:

- Rewards. Licensees are rewarded part of the Core reserves. A Licensee’s rewards reflect the TVL that is borrowed from the Core through its front-end. The greater the amount borrowed, the greater the rewards.

- No out-of-pocket licensing or whitelisting fees.

- Residual will not charge development or maintenance fees.

- Expansion of product offerings to both existing and potential users.

- Removal of the need to build, test, maintain and audit a similar platform in-house.

- The Core has undergone extensive security tests and audits; most notably Trail of Bits successfully completed an audit just a few months ago.

- In-house Core access means that a Licensee’s users no longer have to visit potentially risky third-party lending services.

User benefits of accessing the Core via a front-end:

- Users can access global liquidity pools that are also accessed by users of other front-ends. As more users are introduced through new front-ends, the size of these liquidity pools is expected to grow significantly.

- Users can earn APY by supplying assets.

- Users can earn profits by shorting assets:

- Supply asset

- Borrow asset to be shorted

- Swap out of borrowed asset into a stable coin on a DEX/CEX

- Swap back into borrowed asset at a lower price

- Pay off borrowed asset

- Users can take advantage of arbitrage opportunities:

- Supply asset

- Borrow asset

- Use borrowed asset to invest elsewhere. Profits or APY earned elsewhere should be greater than the Core spread (spread = borrow APY less supply APY, which is the effective cost of borrowing in the Core).

- The Core has undergone extensive security tests and audits.

- The front-end templates used to access the Core are designed for optimal user experience and ease-of-use.

Diagram I: Global Liquidity Pool “Core” Schematic

Forecast

There are a variety of key performance indicators (KPIs) to consider when measuring the success of the Balancer-Residual collaboration. The key driver of value for Balancer will be the Total Value Locked (TVL) borrowed from the platform. Residual expects approximately a third of Balancer’s users to be interested in using BalancerP2P’s deposit capabilities alone, without necessarily leveraging themselves or executing one of the shorting strategies discussed earlier. Given where Residual has seen market rates for borrowing, Residual expects Balancer’s treasury to earn a 10% royalty on the estimated 3% reserve fee revenue (refer: Table 1). This 30bps is almost double to triple the standard 0.125% broker fee other borrowing lead-generation platforms receive.

Table 1: Pro Forma Licensing Revenue for Balancer Treasury

The figures above represent estimates made by the management of Residual for the purposes of illustrating the potential revenue stream for Balancer’s treasury. These estimates should not be relied upon as anything more than Residual’s best guess as to the volume the Balancer user base would generate. Residual started with an aggressive growth curve for 2023, assuming a general market turn-around and increased adoption of Balancer as BalancerP2P and other products are added to Balancer’s offering.

In this model, for instance, Residual assumes that average borrows can reach $200 million by the end of year 2, and continue experiencing significant growth in the following years. One way to verify or validate this assumption is by extrapolating from current usage trends. If just a tenth of the current daily trade volume went into deposits and was held there, then by year-end, the outstanding borrow balance would be around $50 million.

Additional to the above projections, BalancerP2P saving, lending and borrowing activity is estimated to result in a 30-40% increase in Balancer’s trading volume, thus resulting in an increase in its trading-derived revenues. The basis of this estimate is as follows:

Cointelegraph reports that, “… utilization rates, or the percentage of stablecoins taken out as loans versus total supplied, have also fallen to around 30% to 40%… “. Considering that the main use cases for borrowing off Pool-to-Peer lending platforms at present are for shorting from one of the liquidity pools and/or for leveraging into another purchase (note: debt consolidation, one-time purchases, “quiet selling”, etc., are all considered, but are not the main drivers behind margin borrowing in crypto), Residual foresees similar metrics for Balancer; whereby its users will supply onto BalancerP2P, borrow stables, wBTC or ETH, and use those funds to swap into new tokens through Balancer.

Interest Rate Models and Pricing Oracle

The Core’s current APY model for USDC, DAI, and USDT is a JumpRate Version 2 model described in detail here: Interest Rate Model - C.R.E.A.M. Finance

The model calls for the following inputs when calculating an APY:

Base Rate (Borrow) that includes a floor borrow rate, and logic to increase the borrow rate depending on utilization. At a certain utilization, or percentage of borrows vs total supply, the rate “jumps” to provide a repayment and supplying incentive.

The jump rate for borrowing includes factors such as:

- A multiplier based on utilization;

- A JumpMultiplier when utilization exceeds a “Kink” amount; and

- A Kink amount or utilization rate above which triggers the JumpMultiplier.

The existing factors for each pool that determine its utility include:

-

Collateral Factor: The Collateral Factor is the percentage of value that one is able to borrow against their total supply value. Looking at historical price data, Residual found a 90% collateral factor on stables to be a sensible choice. This higher collateral factor helps protect accounts’ positions from volatility of asset prices, and from liquidations. This assumption is based on Gauntlet’s simulation risk report done on the Compound protocol. (Gauntlet).

-

Reserve Factor: The Reserve Factor is the percentage revenue the platform earns from its borrowers based on current borrow APYs and outstanding balances. Residual has lowered reserve factors to 15% to align with and beat other market participant’s settings. (The reserve factor is used to calculate the reserves collected, aka the Reserve Fee, whereby the Reserve Fee = Borrow APY * Reserve Factor).

The Core relies on an accurate token price oracle to constantly confirm margin balances versus borrowing limits (i.e. token price values in USD are also used for reporting purposes). Token prices in the Core are derived from a Chainlink® oracle. The Chainlink oracle was chosen for its accuracy and reliability - to avoid sudden hiccups in value accidentally triggering liquidations. As part of this proposal, Residual will bear the cost of maintaining the oracle as well as other elements of the infrastructure requiring regular maintenance and payments.

Here is an example of the USDC interest rate model:

Diagram II: Interest Rate Model (Example)

Changes to the interest model are controlled via Residual’s policies and procedures. These procedures include internal governance meetings to review the overall performance of the Core. Residual compares its rates and utilization to its competitors, along with the other factors mentioned above. It is Residual’s goal to maintain a leading position in terms of the highest supply APYs and the lowest borrow APYs available. Residual does not control all the market conditions required to meet those goals, but Residual does monitor and market the Core and its front-ends accordingly.

If through the governance process, a decision is reached regarding a factor adjustment, then the impact of the change is socialized across a variety of channels. If the impact of the change will result in an inattentive user being negatively impacted, then the change is voted on by members of the eRSDL (unFederalReserve) community. As a software provider, Residual strives to abstain from making changes to the Core’s parameters, in favor of letting market conditions play out.

Security

Residual considers user and product security a top priority. The implementation team, in collaboration with third-party auditors and experts, has worked hard to build a Core that is secure and dependable.

The Core is managed in-house by Residual and has governance and security protocols in place that prevent corruption of its contracts. From a process perspective, changes to the Core’s key terms and provisions require management review, approval, and robust testing before publishing. Most changes fall into the category of adding tokens to the platform or adjusting interest rate pricing factors to optimize utilization.

Furthermore, the Core shares the same codebase used by unFederalReserve’s institutional permissioned and overcollateralized Pool-to-Peer platform, ReserveLending+, which has also undergone multiple rounds of security testing including an audit by Trail of Bits.

List of audits

The addresses for the Core’s contracts are listed below:

| Name | Initializations | Address |

|---|---|---|

| unFederal eRSDL | uneRSDL | 0xE4cC5A22B39fFB0A56d67F94f9300db20D786a5F |

| unFederal ETH | unETH | 0xFaCecE87e14B50eafc85C44C01702F5f485CA460 |

| unFederal USDC | unUSDC | 0x6b576972de33BebDe3A703BfF52a091e79f8c87A |

| unFederal DAI | unDAI | 0x2dbA05B51eF5A7DE3E7c3327201CA2F8a25C2414 |

| unFederal USDT | unUSDT | 0x6e2aA5bB90ac37D9006685AFc651ef067E1c7b44 |

| unFederal WBTC | unWBTC | 0x5D446FC8DBd10EBAcfE9A427aB5402586af98cD4 |

| unFederal AAVE | unAAVE | 0xD837eCa6C91c67D98461A411BA2f00bdA9960a9D |

| unFederal YFI | unYFI | 0x9e29Ce9cD25F4141dF6BB85b27Ef6933a16A5824 |

| unFederal LINK | unLINK | 0x031002d15B0D0Cd7c9129d6F644446368deaE391 |

The following were security audits performed over these contracts. Please note that these audits do not include the 5,000+ hours of Q&A performed by an internal, independent team dedicated to that function.

- Trail of Bits (ReserveLending+, which includes white-listing) - unFederalReserve - Final Report (4.19.22).pdf - Google Drive

- Coinspect 2021 - Coinspect-UnFederalReserve Smart Contract Audit v210413.pdf - Google Drive

- All Compound® audits completed prior to April 2021

Regulatory Compliance

Residual maintains a robust AML policy consistent with its role as software provider for a self-custodial product. Residual is FinCEN registered as a general entity; meaning that it is not obligated to report suspicious activity, however it chooses to do so in order for the unFederalReserve ecosystem to present to regulators in a manner consistent with expectations. Residual maintains consumer lending counsel among other attorney groups for this such purpose, and users of BalancerP2P should expect to checkbox their understanding and agreement to end user terms of use. Users are also subject to the platform’s privacy policy which may change from time to time to align with evolving regulations.

Bad Borrowers and Recourse

Over-collateralized borrowing and lending reduces concerns around an individual’s willingness and ability to pay, and instead focuses on the use of collateral as the security interest against borrower default. The technology of the Core allows for liquidation bots to pay off loans whose outstanding balance as a percentage of its related collateral exceeds the collateral factor. However, there are instances where highly volatile collateral will drop too quickly for the bots to liquidate the loan. In those instances, vast amounts of loans may become unsecured. Worse still, as the value of the collateral rises, bots may re-engage and liquidate default loans as the price of the collateral rises; thus, putting sell pressure on the collateral token until all the liquidations have been cleared.

Options are limited here, but thankfully, the instances where enforcing recourse are few. One concept toyed around with by permissionless lenders is the dropping of forgiveness letter NFTs into the offender’s wallet, informing the borrower of the tax implications of a forgiven loan in an effort to encourage paying back the loan. In general, the best way to limit these occurrences is to only allow stable collateral at reasonable borrow caps in those wallets. Residual does not currently cap the amount of a given token that can be borrowed, but this might be a feature to consider leveraging if utilization reached and held a rate untenable for long-term platform viability.

A development for which Residual advocates includes “Supplier’s Rights”, where supplier’s en masse can vote to: impair bad debts on the platform, encourage an offending party to repay its loans, or split the collateral that remains on a pro rata basis.

Risks and mitigation strategies

| Risk Category | Specific Risk | Mitigation Strategy |

|---|---|---|

| Technology Risk | A failure of the BalancerP2P front-end to accept wallet connections, supplied assets, borrows, and/or reflect true and accurate information regarding interest rates, amounts, prices, etc. | Residual’s smart contract Core and front-ends have undergone multiple security audits and QA testing rounds. Residual will continue periodic review and testing, and address customer issues as they arise. |

| Reputation Risk | A BalancerP2P issue (real or perceived) causes people to associate that failure with the broader Balancer platform. | We are all in this together. An issue related to a specific user’s experience affects the entire product line and will be addressed immediately. We (Residual) have undergone crisis management training, and during the volatility of 2021/2022, have experienced handling FUD (real or perceived) across multiple channels. Transparency is the key to folks having confidence in a product. Residual will also support Balancer’s larger publicity strategy in the event of a disruption that affects both platforms. |

| Financial Risk | Cascading liquidations due to massive market price corrections | We cannot control borrowers over-exposing themselves relative to the riskiness of their collateral. Liquidations are a healthy and natural part of any P2P platform. (Consider the analogy of the little bird that cleans alligator teeth). The Core uses a Chainlink pricing oracle to avoid pricing spikes of any of the listed tokens accidently booting borrowers off the platform. This is the best anyone in the industry can do right now to prevent sporadic liquidations. Cascading liquidations might affect collateral price and impact individual borrowers, but would not pose a risk to either company. |

| Political Risk | Custody rules change or regulatory rules around custody change. | Compound is self-custodial. The DAO, Residual, etc. have no control over the users’ assets at any time. As a technology enabler, Residual is facilitating people transacting with one another and does not see any current pipeline legislation here or abroad that would impact its ability to operate the BalancerP2P in a regulatory compliant manner. |

| Legal Risk | Suppliers or borrowers disagree with the terms and conditions of the loans after they have entered into these agreements and choose to litigate. | Residual has invested tens of thousands of dollars in legal fees designing and implementing the first P2P lending and borrowing agreement that accounts for the nuances of self-custody, changing lenders, changing borrowers, collateral and interest rates. We at Residual are extremely proud of this document that NO OTHER COMPOUND FORK employs to protect users, sponsors, affiliates and supporters of both unFederalReserve and all front-end Licensees. (Note: Residual engages with three law firms - a general counsel (outsourced), consumer lending counsel, patent and trademark counsel). |

Conclusion

Residual is excited to offer this opportunity to the Balancer community. Residual believes that the increased utility of Balancer’s tools via BalancerP2P will make it a leader amongst its peers. Thank you for taking the time to read through this proposal, asking questions and allowing us to address any concerns you may have.

—------------------------------------------------------------------------------------------------------------------------

1 Overcollateralized Pool-to-Peer (P2P) Lending vs Centralized Alternatives

In Overcollateralized P2P Lending, users (lenders) supply assets to a liquidity pool. The lenders can also use their supplied assets as collateral to borrow assets from the pool (thus becoming borrowers). The borrowers are overcollateralized, meaning the value of their collateral exceeds the value of their borrow. The Collateral Factor determines how much a borrower can borrow relative to their supplied collateral. The borrowers are charged interest (borrow APY), and the Reserve Factor determines how much of this interest is awarded to lenders (supply APY), and how much is collected by the operators of the protocol (in the protocol’s ‘reserves’).

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Although the material contained in this website was prepared based on information from public and private sources that Residual Token, Inc. d/b/a unFederalReserve believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and Residual Token, Inc. expressly disclaims any liability for the accuracy and completeness of information contained in this or any article.

This article, our website, social media posts and other public forum materials are distributed for general informational and educational purposes only and is not intended to constitute legal, tax, accounting, or investment advice. The information, opinions and views contained herein have not been tailored to the objectives of any one individual, are current only as of the date hereof and may be subject to change at any time without prior notice. Residual Token, Inc. does not have any obligation to provide revised opinions in the event of changed circumstances.

All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a finance, tax or legal professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal objectives, needs and risk tolerance. Residual Token, Inc. expressly disclaims any liability or loss incurred by any person who acts on the information, ideas or strategies discussed herein.