Since the start of our partnership in late 2022 (BIP-103), kpk has served as Balancer DAO’s strategic treasury partner, supporting the ecosystem through non-custodial asset management, protocol integrations, and financial infrastructure. The first half of 2025 continued this momentum with renewed focus on operational excellence, strategic collaboration, and portfolio resilience.

This update provides a detailed review of treasury activity and broader kpk contributions from January through June 2025.

The timeline below highlights our key contributions to Balancer DAO from the beginning of 2024 onwards:

Financial Update

kpk-Managed Treasury

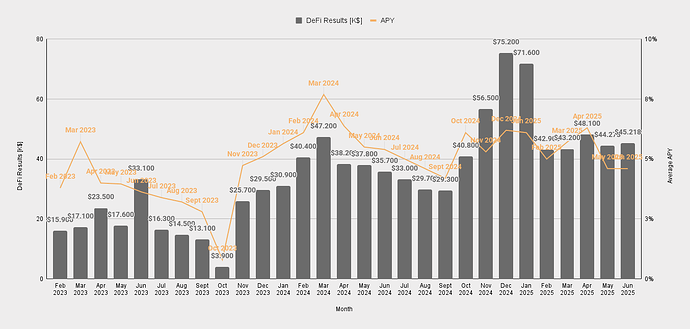

In the first 6 months of 2025, the Balancer’s kpk managed treasury has achieved:

- Accumulated net revenue of $295,291.

- An average APY of 5.4%.

Figure 1: DeFi results [K$] and APY since Feb 2023

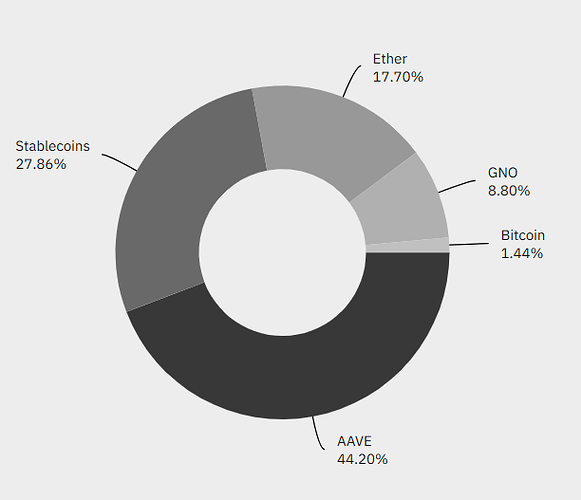

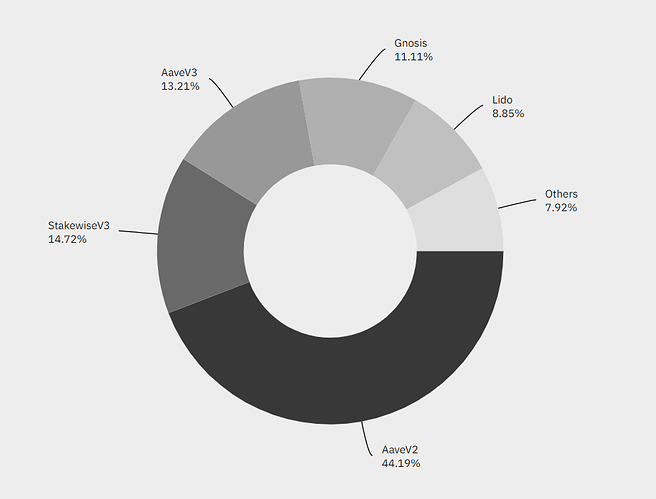

Based on the most recent monthly report detailing the treasury’s performance for June 2025, Balancer DAO’s managed treasury has:

- $12.1 M of ncAUM (non-custodial assets under management).

- 100% capital utilisation (allocated funds in DeFi).

- An APY of 4.6%.

- Monthly DeFi results of $45,218.

Figure 2: kpk-managed treasury’s asset allocation

Figure 3: kpk-managed treasury’s blockchain exposure as per BIP-696 and BIP-732.

Figure 4: kpk-managed treasury DeFi protocols exposure

Balancer DAO Trends

-

A step change in treasury architecture

As part of our commitment to building a more capital-efficient and sustainable treasury, the approval of BIP-850 marked a step change in Balancer DAO’s treasury architecture. kpk led a comprehensive review of all positions, categorising assets by mandate, liquidity profile, and operational relevance, and designed a multi-chain migration plan. Execution is ongoing across Ethereum and Arbitrum, with other networks to follow. Positions are now clearly segmented between those designated for yield strategies, those to be held as-is, and we’ll ensure USDC and BAL are streamed to the DAO Multisig in line with funding requests posted on the forum. Once the migration is complete, asset allocation will be managed in accordance with the Investment Policy Statement (IPS). -

Liquidity alignment with ecosystem partners

In H1 2025, Balancer strengthened its strategic integration with CoW Protocol. The successful expansion of CoWAMM pools further established Balancer as a key liquidity layer for CoW Swap. This helped consolidate shared infrastructure and drive protocol-level capital efficiency.

BIP-628 outlined a broad strategic alignment between Balancer DAO and CoW DAO, including token swaps, shared liquidity commitments, and CoWAMM infrastructure integration. CIP-69 represents the first step in implementing this vision, formalising a token swap to align incentives and support the next phase of collaboration. -

Stable operations, lean positioning

In the first half of the focus was on managing and monitoring existing allocations, including a position involving stkAAVE to secure discounted GHO borrowing, backed by WBTC and USDC collateral. This steady approach supported capital preservation, ensured liquidity for the DAO’s needs, and remained fully aligned with the Investment Policy Statement (BIP-843). -

Sustained transparency through reporting

In H1 2025, kpk continued publishing monthly financial reports on the Balancer governance forum (as per BIP-684), covering treasury balances, asset movements, and funding activity. These updates play a key role in maintaining transparency, supporting informed governance, and ensuring the DAO has a clear understanding of its financial position and roadmap ahead. The reports also help track the implementation of treasury initiatives and serve as a reference for contributors and stakeholders across the ecosystem. -

Growing maturity in operational systems

In H1 2025, kpk introduced the Sub-Roles modifier through BIP-842, delivering a modular permissioning system to enhance Balancer’s execution infrastructure. The design originated from the first iteration of kpk’s architecture and was refined by our technical team following constructive discussions on the Balancer forum. This framework enables more granular control over treasury functions, preserves auditability, and supports a clear separation of responsibilities. -

Proactive risk monitoring across the stack

Through integration with Hypernative, the treasury now benefits from over 90 real-time, custom-built, alerts monitoring specific protocol risks such as oracle, governance, liquidity and potential hacks / exploits. This monitoring framework plays a key role in supporting any future automation and complements the DAO’s increasing focus on resilience.

Lookback on the Mandate

In the first half of 2025, kpk remained focused on executing its role as Balancer DAO’s strategic treasury partner. Efforts centred on delivering reliable operations, strengthening internal systems, and ensuring all treasury activity aligned with the DAO’s governance and financial priorities.

- Operational execution and treasury oversight

kpk maintained responsibility for routine treasury operations across Ethereum Mainnet and Gnosis Chain. These included position monitoring, transaction execution, and permissions management. Execution followed established controls and respected all governance-defined constraints, ensuring actions were traceable, efficient, and aligned with the DAO’s investment guidelines. - System design to support decision-making

In preparation for the transition outlined in BIP-850, kpk contributed to the design of new operational workflows to support the DAO’s evolving treasury model. This included setting up execution processes for working capital refills, defining permissioning standards, and supporting clear handoff mechanisms between DAO signers and the managed Safe. These systems aim to improve consistency and accountability across treasury actions while enabling the DAO to retain oversight as responsibilities scale. Coordination with the Balancer Foundation was key to ensuring these structures are fit-for-purpose and ready to support the next phase of treasury management. - Sustained collaboration across the DAO

Throughout H1, kpk worked closely with the Balancer Foundation, Maxis, and contributors across governance, reporting, and strategy discussions. This ongoing coordination helped ensure DAO-approved decisions were implemented with clarity, consistency, and full operational context. - Exceeding the IPS baseline

In H1 2025, we stewarded the preparation and ratification of a new investment policy statement (IPS) for Balancer DAO. The IPS provides a conservative framework of baseline expectations and standards for our work. In this report, we’re pleased to confirm that the core expectations of the IPS have been met consistently since its formal adoption, and that the range of contributions we have delivered continue to extend and reach past the baseline outlined in the IPS. In H1, we introduced the Sub-Roles architecture, developed automation infrastructure tied to real-time alerts, helped craft the Migration actions with the Balancer Maxis and developed enhanced due diligence processes to support scalable risk analysis. These additions have helped push the boundaries of our work and the details of the IPS, and were introduced to equip Balancer DAO with stronger execution capacity, faster risk response systems, and a more scalable framework for long-term treasury operations. We will continue to update and reissue the IPS over time as the scope of our work continues to expand and change.

kpk remains committed to supporting Balancer DAO with disciplined execution, sound treasury systems, and trusted operational stewardship.

Looking Forward

As we enter the second half of 2025, kpk remains focused on strengthening Balancer DAO’s financial architecture and supporting the protocol’s long-term growth. Our priorities reflect both the maturity of the current treasury framework and the DAO’s evolving strategic needs.

Scaling protocol-aligned liquidity

kpk will continue supporting Balancer in expanding its liquidity footprint by onboarding new partners into the ecosystem. This includes engaging aligned DAOs, DeFi-native treasuries, and institutional capital providers to deepen pool liquidity and reinforce Balancer’s position as a core liquidity layer across different networks.

Improving capital efficiency and portfolio alignment

Efforts will focus on reallocating idle assets into risk-aware, yield-generating strategies and progressively unwinding legacy positions that no longer align with the DAO’s current goals. These actions will be guided by updated due diligence, market conditions, and the DAO’s financial priorities.

Enhancing operational resilience

We plan to refine execution workflows, strengthen automation capabilities, and reinforce risk controls across the treasury. Growing the DAO’s stablecoin reserves also remains a key objective to support predictable funding, reduce volatility exposure, and ensure flexibility under various market scenarios.

Driving token-aligned value

kpk is contributing to the development of a BAL Token Sustainability Plan. The initiative is designed to improve long-term alignment between the treasury and protocol incentives by increasing on-chain liquidity and supporting healthy token distribution dynamics.

Looking ahead, our focus is to deliver reliable, transparent treasury operations that evolve alongside Balancer DAO’s ambitions while protecting its financial strength and flexibility.

Balancer’s TVL facilitated by kpk

| Position | Blockchain | TVL |

| wstETH/GNO-Unstaked | Gnosis | $10,043,002.57 |

| sDAI/USDC.e/USDT (sBAL3)-Unstaked | Gnosis | $3,813,439.04 |

| COW/WETH-Unstaked | Ethereum | $3,739,902.51 |

| WBTC/WETH-Unstaked | Gnosis | $2,780,562.82 |

| WETH/GNO (CoW AMM-f72d)-Unstaked | Gnosis | $2,533,656.17 |

| sDAI/wstETH-Unstaked | Gnosis | $2,464,676.18 |

| wstETH/WETH (ECLP)-Unstaked | Gnosis | $2,180,417.02 |

| wstETH/sDAI (CoW AMM-b72e)-Unstaked | Gnosis | $2,025,300.34 |

| osGNO/GNO-Unstaked | Gnosis | $1,384,398.23 |

| wstETH/WETH-Unstaked | Gnosis | $1,338,478.67 |

| COW/wstETH (CoW AMM-d2f1)-Unstaked | Ethereum | $1,268,807.89 |

| rETH/WETH (ECLP)-Unstaked | Gnosis | $1,088,795.53 |

| GNO/SAFE (CoW AMM-c286)-Unstaked | Gnosis | $901,381.17 |

| GBPe/sDAI-Unstaked | Gnosis | $849,963.46 |

| Locked B-80BAL-20WETH | Ethereum | $719,745.08 |

| USDC/WETH (CoW AMM-8b91)-Unstaked | Ethereum | $671,343.09 |

| wstETH/COW-Unstaked | Gnosis | $631,858.30 |

| GNO/OLAS (CoW AMM-5400)-Unstaked | Gnosis | $590,308.67 |

| wstETH/BAL/AURA-Unstaked | Gnosis | $554,659.07 |

| stEUR/EURe-Unstaked | Gnosis | $542,487.47 |

| GNO/COW (CoW AMM-0bae)-Unstaked | Gnosis | $472,079.91 |

| COW/GNO-Unstaked | Gnosis | $462,262.09 |

| rETH/WETH-Unstaked | Ethereum | $390,117.15 |

| SAFE/GNO-Unstaked | Gnosis | $383,548.65 |

| WBTC/wstETH-Unstaked | Gnosis | $146,359.82 |

| 50wstETH/25WBTC/25SOL (CoW AMM-1d32)-Unstaked | Ethereum | $90,311.86 |

| GIV/GNO-Unstaked | Gnosis | $59,499.63 |

| WXDAI/GNO-Unstaked | Gnosis | $14,396.95 |

| WBTC/wstETH (CoW AMM-6be4)-Unstaked | Ethereum | $2,267.46 |

| COW/GNO-Unstaked | Ethereum | $2,188.64 |

| bb-a-USD (v3)-Unstaked | Ethereum | $482.55 |

| Total | $42,146,698 |