Summary

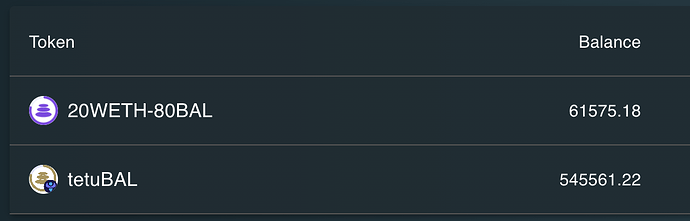

The Tetu Protocol has been actively building within the Balancer ecosystem, with tetuBAL serving as its primary Balancer-focused product. The aim of tetuBAL is to provide Polygon users access to the yields of Balancer, without the hassle of bridging or incurring in high gas fees. Recently, in line with its strategic long term vision, Tetu deployed on the Ethereum Mainnet, to offer its users the benefits of its cutting-edge strategies with a deeper liquidity provision.

In order to further boost liquidity for Balancer and secure more permanently locked veBAL, Tetu is requesting the whitelisting of its mainnet tetuBAL gauge. This will incentivise users to maximise their locking boost and contribute to the overall success of the platform. The inclusion of Mainnet tetuBAL gauge will further strengthen the partnership between Tetu and Balancer, and help to position both protocols as leaders in the DeFi market.

References/Useful links:

-

Website - https://tetu.io/ 2

-

Documentation - Introduction - Tetu

-

Github Page - Tetu · GitHub

-

Communities - Tetu

Protocol Description

Tetu is an asset management protocol that implements automated yield farming strategy for users.

Motivation

Tetu has a vision of becoming an integral partner for Balancer and continuing to develop innovative products that increase liquidity and solidify the protocol’s place as a cornerstone in the rapidly expanding DeFi landscape. To reach these goals, Tetu realises the importance of expanding its reach to the Ethereum Mainnet, which has a much larger audience than Polygon and a substantially higherl user base.

In alignment with Balancer’s long-term vision, Tetu’s expansion strategy includes offering tetuBAL in order to take advantage of the potential of perma-locked veBAL. This will allow Tetu to create new solutions that maximise the return on investment for Balancer and Tetu’s end-users. By providing perma-locked veBAL, Tetu can enjoy the necessary stability to build a strong and sustainable partnership with Balancer.

Moving to the Ethereum Mainnet is a crucial step in the long-term growth and success of Tetu. By accessing a much larger pool of users and partnering with Balancer, Tetu will be able to offer even more comprehensive strategies.

We believe that Tetu’s move to the Ethereum Mainnet represents a significant opportunity to further grow and expand both protocols and to provide users with the best possible opportunities. By leveraging the potential of perma-locked veBAL and partnering with Balancer, Tetu is poised to become a leader in the DeFi market and to make a lasting impact on the Balancer ecosystem.

Specifications

- Governance: Multi Sig - Tetu

- Oracles: No

- Audits: docs.tetu.io

- Centralization vectors: n/a

- Market History: Tetu token can be volatile in the certain market conditions.

uncapped gauge: 0x45280c7FE46Bd875E23D3820e89daA4C70fA2C34