[BIP-XXX] Balancer Ecosystem Roadmap Proposal and Funding

Pledge to abide by [BIP-702] Balancer DAO Service Provider & Grantee Standards: Yes

Authors: @0xDanko @Marcus @Xeonus @danielmk @mendesfabio @Mike_B

Intro

This document outlines a strategic roadmap for Balancer, charting a course for the next four quarters from Q2-2025 (retroactive) through Q2-2026. This proposal is designed to provide a clear and cohesive framework for our community, contributors, investors and the wider DeFi and Ethereum ecosystem. Our goal is to align our collective efforts behind a unified vision, ensuring that every initiative we pursue contributes directly to our long-term success.

Motivation

In past years, SPs submitted individual budgets and proposals. This created fragmented demands, overlapping responsibilities, and limited visibility for tokenholders. A unified proposal solves this by:

- Clarity: The DAO votes once on the whole plan, not on disconnected pieces.

- Efficiency: Reduces overhead and avoids duplicated spending.

- Accountability: Funding is tied directly to measurable goals and KPIs.

Learnings and Path to a Unified Proposal

Since the BIP-01 framework, Balancer has matured from siloed SPs into an integrated ecosystem. Collaboration across SPs naturally evolved into a cohesive roadmap. This reflects the DAO’s growing maturity: we can now coordinate as one ecosystem while maintaining decentralization.

A unified proposal strengthens transparency by giving tokenholders a full view of how resources are allocated and how each initiative contributes to agreed deliverables. It also helps us stay lean, eliminating redundancy and ensuring resources flow to the most impactful work.

By clearly defining our needs and aligning them with this roadmap, we can maximize the output of this core resource and lay the groundwork for a more distributed, self-sustaining development ecosystem in the future.

Defining Our Goals

In late 2024 and early 2025, Balancer Labs and SPs started working through a structured strategy process to align on Balancer’s mission, vision, and priorities. Each pillar and goal in this proposal was shaped through workshops and leadership discussions.

The goals were selected to:

- Focus on outcomes most critical for Balancer’s competitiveness and sustainability

- Be measurable, with a clear “definition of done” by end of Q2 2026

- Balancer growth opportunities (market share, innovation) with resilience (sustainable revenue, governance, operational excellence)

Vision and Mission

Vision: Be the most innovative and trusted platform for programmable liquidity that serves as foundation for decentralized finance.

Mission: Empower builders, liquidity providers, and traders with advanced AMM solutions that deliver capital efficiency, drive innovation, and provide seamless access to onchain liquidity for all.

Strategic Pillars and Objectives

Pillar 1: Growth & Market Share

Objective: Achieve 2x TVL Market Share via v3 Adoption on EVM chains

Doubling Balancer’s market share across EVM chains is essential to validating Balancer’s role as a leading programmable liquidity platform. Reaching this milestone signals strong confidence and momentum to both users and investors, driving further liquidity inflows and reinforcing Balancer’s competitive positioning.

Definition of done: Market share (USD and ETH terms) equals or exceeds 2x January 1, 2025 baseline

Pillar 2: Financial Sustainability

Objective: Achieve Sustainable $250,000+ Monthly DAO Revenue Driven by v3 Products

Reaching a stable baseline of $250,000 in monthly DAO revenue is a critical milestone toward long-term sustainability. At this level, the DAO can cover its core operating expenses and demonstrate that v3 products generate meaningful recurring income. However, this target does not yet account for the independent budget of Balancer Labs. The long-term ambition remains to fund all service providers directly through organic fee income to the DAO. Achieving $250,000+ monthly revenue to the DAO is therefore a first, but essential, step in that trajectory.

Definition of done: Two consecutive months with monthly revenue of $250,000+ to the DAO treasury

Objective: 50%+ Revenue from Sustainable Products

Balancer’s long-term viability depends on products that generate fees because they deliver real value to users, not because they are subsidized by incentives. Reaching a point where over 50% of DAO revenue comes from sustainable sources, specifically non-incentivized pools or pools whose fees exceed BAL emissions, demonstrates that Balancer products can stand on their own merit. This milestone signals the protocol’s ability to attract and retain liquidity organically. It validates the design of Balancer v3 and strengthens the path toward long-term profitability.

Definition of done: For two consecutive months, at least 50% of DAO revenue originates from non-incentivized pools or from pools where fees exceed BAL incentives.

Pillar 3: Innovation & Product

Objective: Develop and Launch a Market-Leading Solution for Fungible Concentrated Liquidity

Concentrated liquidity is now the standard for volatile pairs, and Balancer must deliver a strong solution to stay competitive. With reCLAMMs and Gyro CLPs already developed, the focus is on driving adoption. A market leading product will improve volume metrics, increase capital efficiency for LPs, and strengthen Balancer’s position among top DEXs.

Definition of done: Concentrated liquidity products account for at least 20% of Balancer TVL and 40% of Balancer trading volume..

Objective: PoC of 2+ Innovative Products with Strong Product Market Fit

This objective ensures Balancer keeps its innovation pipeline active by deploying at least two proof-of-concept products in controlled environments. These PoCs will be tested to validate their design, economic viability, and potential product market fit, without requiring a full public launch. This approach allows Balancer to continue exploring new concepts and to be ready with proven solutions that can scale when the time is right. StableSurge is an example of a product that began as a PoC and successfully proved product market fit before being scaled.

Definition of done: At least two proof-of-concept products are deployed and tested, with validation showing strong potential product market fit even if not fully launched.

Objective: Have 3+ External Teams Operating on Balancer v3 with $50M+ TVL

Balancer v3 was designed as a platform to accelerate AMM development, and achieving this objective is key to fulfilling that vision and remaining competitive. By having at least three external teams operating products on the protocol, Balancer will showcase its utility and developer friendliness. A central part of this goal is ensuring clear fee split arrangements with these teams, creating aligned incentives that reward builders while strengthening DAO revenue. Reaching $50M+ in combined TVL from these teams will demonstrate meaningful ecosystem adoption and validate Balancer’s role as a platform.

Definition of done: At least three external teams are operating products on Balancer v3 with established fee split arrangements, and together their deployments account for $50M or more in TVL.

Objective: Operationalize the Balancer Grants Program

A structured grants program is essential to accelerate innovation by tapping into the wider ecosystem’s talent pool rather than relying only on existing service providers. By establishing a focused and closed scope program, Balancer can ensure that all funded work directly addresses critical protocol needs. This approach, inspired by successful models like the CoW Grants Program, will improve development velocity and create clear requirements and measurable success metrics for funded projects.

Definition of done: At least five grants are awarded under the new framework by mid 2026, with results meeting the success criteria defined in the program’s evaluation metrics.

Pillar 4: Ecosystem & Governance

Objective: Have 7 Strategic DAOs Participating in veBAL Governance

The participation of external DAOs in Balancer governance is a cornerstone of long-term decentralization and ecosystem growth. Strategic partners that stake and vote with veBAL demonstrate commitment to the protocol by aligning their economic and social interests. Programs such as the Balancer Alliance can support this participation, but the key outcome is a stronger governance process that secures long-term TVL, broadens representation, and ensures diverse and resilient decision-making.

Definition of done: Seven DAOs hold veBAL positions and each participates in at least two governance votes during the period.

Pillar 5: Operational Excellence & User Experience

Objective: Reduce Contributor Churn to Improve Continuity and Team Health

High contributor churn poses a significant threat to our operational stability. It weakens our ability to innovate consistently, leads to costly project delays, and erodes critical institutional knowledge. By reducing turnover, we can strengthen team continuity, improve execution speed, and cultivate a healthier, more engaged contributor environment. The effectiveness of these efforts will be tracked through project delays due to turnover.

Ultimately, our goal is to reduce churn to zero, maintaining a solid team throughout the course of 2025/26 and the fulfillment of the metrics on our roadmap.

Key Metric: Turnover analysis, exit surveys, project delays.

Objective: Improve User Experience and Partner Onboarding to Drive Retention

Poor user experience directly impacts our market position by leading to decreased engagement, lower TVL, and reduced protocol adoption. By focusing on improving the user experience and streamlining partner onboarding, we aim to build trust, increase satisfaction, and create a sustainable ecosystem that attracts and retains both retail and institutional users. The success of this initiative will be measured by user and LP retention rates and feedback gathered through user surveys and Net Promoter Scores (NPS).

Definition of Done: User and LP retention improves, with measurable churn reduction and positive feedback reflected in user surveys and Net Promoter Score (NPS).

Objective: Establish Clear, Scalable Processes Without Losing Agility

Clear and scalable processes are essential for improving coordination, reducing friction, and preventing knowledge silos. They create operational consistency and efficiency while preserving the adaptability and agility that define Balancer’s competitive advantage. This objective ensures we can systematize our operations while remaining nimble enough to respond to a rapidly evolving market.

Definition of Done: Ten core processes are documented and actively used by the team.

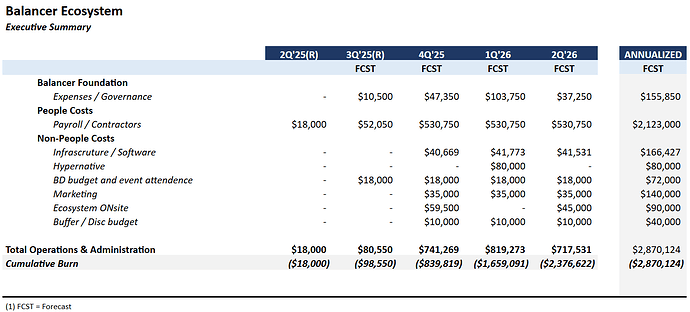

Budget Breakdown

Below is a budget breakdown for Ecosystem costs. It comprehends the Balancer Foundation infrastructure, and its subsidiaries, including service providers, marketing and discretionary budget for unforeseen developments.

Q2’25(R) and Q3’25(R) seeks to retroactively adjust allocations towards initiatives that have been already put in motion, such as new hires, R&D, event attendance, etc.

Balancer Foundation: This line item is a reference to BIP-802, encompassing the same cost footprint, accounting and legal for the entire structure: Balancer Foundation, Balancer OpCo, and Balancer Onchain. All people-costs, except Director fees, were moved to the next line item.

People Costs: This current budget includes the team’s payroll and contractors, except Balancer Labs employees/contractors, which today make for ⅓ of Balancer’s protocol development workforce. The total for the current contributor set is 18 FTE, with an average salary of $9,828.70 USD/month, which will also include the Balancer Maxis (ref. BIP-801) and Beets technical team (ref. BIP-848).

Infrastructure/Software: Continuation of BIP-846. Consist in the essentials for core functionality of the protocol and surrounding infrastructure, i.e. API and RFC providers, DNS server, etc., as well as software subscriptions and diverse service providers, currently being utilized by one or multiple DAO SPs, i.e. Google Workspace, Notion, X, Slack etc.

Hypernative: Expected renewal of security services and advisors (ref. BIP-775)

BD budget and event attendance: Budget allocation for builders and business development to physically attend conferences and other IRL events, such as Token 2029 (Singapore), ETH Latam (Sao Paulo), Devconnect (Buenos Aires), etc. This has moved from BIP-840, which sees a decrease in allocation. We understand our team’s presence in top tier events is great for networking and mind-share, and very much needed to reach the metrics above.

Marketing: Continuation of BIP-840, projected throughout H1/2026. The “Senior Marketer” allocation was moved to People Costs. This comprehends a third-party agency for content production, event sponsorships, and brand building.

Ecosystem ONsite: Twice a year, Balancer teams will meet for a coworking retreat. This budget allocation mimics the latest BIP-860 (cost of ~$3k pax), and projects savings from previous editions.

Buffer: Minor discretionary budget for unforeseen events.

BAL vesting package

Ownership is one of the core Ecosystem Values. After all, that’s one of the beauties of working for DAOs, and why we negotiate token packages with web3 contributors.

Through extensive feedback from both past and active contributors, we’ve recognized that this key value was being overlooked. Too often we focused on shipping while neglecting tokenomics. Contributors reported feeling uncertain about receiving BAL tokens, lacking clarity on expectations (Am I expected to hold? Is it okay if I vote? What about taxes?). Moving forward, we intend to provide greater clarity and place Ownership at the forefront of everything we do for the protocol.

“We are all owners of Balancer, of the work that we do, and of our own experiences. We are constantly thinking about what is best for Balancer. We all feel that we are owners of Balancer protocol and are each responsible for its ultimate success”.

This proposal, seeks to allocate 166,250 BAL towards vesting contracts to be locked either in veBAL, liquid wrappers, or formal agreements.

Conclusion

This strategic roadmap provides a clear and actionable framework for Balancer’s next chapter. It is built on a foundation of professional maturity and a clear understanding of our past learnings. By unifying our efforts under this single proposal, we are not only enhancing transparency and accountability but also strengthening our collective ability to innovate and compete. This document serves as our shared guide, ensuring that every initiative we undertake drives us closer to our vision of being the most innovative and trusted platform for programmable liquidity in the decentralized finance space.

Specification

No technical specification needed

If a YES vote is cast, the Balancer Foundation, through its subsidiaries, will work with @kpk as Treasury Managers to secure 2,870,124 USDC working capital allocation and 166,250 BAL throughout Q2’2026 for the fulfillment of this proposal, and the community can expect high-level updates on a quarterly basis.